As of mid-day, the markets are chopping around rather aimlessly, within a couple tenths of a percent of yesterday's closes. Here is a view of 2011.

After a year of chopping around aimlessly, net gain for the SP 500 is 0.0%. DJI is up a bit, NASDAQ down a bit. This is a market going nowhere. Check out the 5 year plot at Yahoo Finance, and it's a pretty similar picture, but with DJI and NASDQ reversed. Over a five year span, the market has gone nowhere.

Look back since the beginning of the current century, and it's even worse. (Chart snipped from Yahoo Finance, interactive chart.)

The SP500 is down over 12% over this time. The DJI is up 6.6%, while the NASDAQ is off a whopping 32.6%.

This is where the SS privatizers want to put your retirement savings - with Wall Street rentiers skimming the cream off the top. Of course, they will do this irrespective of your gains and losses.

And I think there are plenty of losses looming over the horizon.

Interactive Widget --SPY Mimics S&P 500

Friday, December 30, 2011

Thursday, December 15, 2011

Thursday 12-15

From my view of the wave count in the SP500 index, it looks like the current small level wave down is not yet complete. Subwave 5 of 3 appears to be under way, inching toward the 1200 Rubicon. Not labelled, the high point at the end of trading last Friday is also a wave 2 top, at the next higher level of trend. In fact, most of the touches since July 8 at 2's at some level.

The Rubicon could provide some round number resistance. The lower border of the up-slanting channel highlighted yesterday could come into play as well. With waves 4 and 5 looming in the near future, more meanderings across the 1200 line are quite possible.

When it is finally and convincingly breached on the downside, it will be years, possibly decades, before it is exceeded again in any meaningful way.

Look out below.

The Rubicon could provide some round number resistance. The lower border of the up-slanting channel highlighted yesterday could come into play as well. With waves 4 and 5 looming in the near future, more meanderings across the 1200 line are quite possible.

When it is finally and convincingly breached on the downside, it will be years, possibly decades, before it is exceeded again in any meaningful way.

Look out below.

Wednesday, December 14, 2011

Channels, and More Channels

A few days ago, I wondered if the early December surge in the SP 500 Index would reach the top of the trading channel. It did. Here's an updated look.

It touched the channel top on Dec 7, and has been dropping since. I've outlined a few channels. The big one originated with the July 8 peak, and its top line has been touched several times since.

The lower channel boundary is a parallel line off the August 9 bottom. Upward activity has been within a channel made by connecting the Oct 4 and Nov 28 lows to define the bottom. I've place the top boundary on the Aug 31 high. Other interpretations are possible. I like both of these channel definitions because the mid-lines seem to have some support-resistance characteristics.

I've also included a new down-sloping channel from the Dec 7 top. This may broaden if downside activity picks up. As things are headed, the index could break out of the up-sloping channel just about as it crosses the Rubicon, one more time.

It touched the channel top on Dec 7, and has been dropping since. I've outlined a few channels. The big one originated with the July 8 peak, and its top line has been touched several times since.

The lower channel boundary is a parallel line off the August 9 bottom. Upward activity has been within a channel made by connecting the Oct 4 and Nov 28 lows to define the bottom. I've place the top boundary on the Aug 31 high. Other interpretations are possible. I like both of these channel definitions because the mid-lines seem to have some support-resistance characteristics.

I've also included a new down-sloping channel from the Dec 7 top. This may broaden if downside activity picks up. As things are headed, the index could break out of the up-sloping channel just about as it crosses the Rubicon, one more time.

Saturday, December 3, 2011

April - Nov 2011

Were you excited by that big end-of-the-month stock market surge this week? Let's put it in perspective. Here are daily closing values for the SP500 index.

Several weeks ago I put a red trend channel top line connecting the high points of 7/07 and 10/28. A parallel channel bottom extends from the 8/08 low. A mini-peak on 11/08 reached out and touched the top line again, marking the end of an up-sloping channel dating from the 10/03 low. After that, the index fell - once again faltering at its mid-line, and bounced off the yellow mid-line of the down-sloping channel on 11/25. That was last week's surge; it peaked on 11/30, with two days of no follow-through. Unless there is positive action in the next few days, this increase will have faltered without challenging the channel boundary.

The heavy red down-slanting line at the top goes back to the peak in 2007. Longer range views can be seen here and here (second chart.)

Here's another look at the last five years.

The heavy green line slanting up from just below 700 on the ordinate axis connects bottoms all the way back to the early 80's. The last touch prior to the march '09 piercing was in February 1991. Should that line fail as support, there is no other support line.

Anywhere.

I truly believe we are witnessing the advent of The New Dark Ages.

Several weeks ago I put a red trend channel top line connecting the high points of 7/07 and 10/28. A parallel channel bottom extends from the 8/08 low. A mini-peak on 11/08 reached out and touched the top line again, marking the end of an up-sloping channel dating from the 10/03 low. After that, the index fell - once again faltering at its mid-line, and bounced off the yellow mid-line of the down-sloping channel on 11/25. That was last week's surge; it peaked on 11/30, with two days of no follow-through. Unless there is positive action in the next few days, this increase will have faltered without challenging the channel boundary.

The heavy red down-slanting line at the top goes back to the peak in 2007. Longer range views can be seen here and here (second chart.)

Here's another look at the last five years.

The heavy green line slanting up from just below 700 on the ordinate axis connects bottoms all the way back to the early 80's. The last touch prior to the march '09 piercing was in February 1991. Should that line fail as support, there is no other support line.

Anywhere.

I truly believe we are witnessing the advent of The New Dark Ages.

Saturday, November 19, 2011

A Slightly Longer View

Here is a look at the SP500 Index since the beginning of August - daily bars.

I've outlined three channel that have been in existence since the 8/09 bottom. The first, in purple, starts with that bottom. It was badly breached in late September - early October. An expanded trend channel, at double the width (not shown) would come close to containing the October 4 low.

The blue channel, up from there, outlines a steep and dramatic retracement. This trend topped on October 27, and the index has been sliding since. I've placed the red channel lines around this decline.

I thought the purple channel was gone after the late September drop, but the lower boundary has been touched several times since mid-October. If the red channel has any validity, this week's penetration of the purple channel bottom signals a new phase of decline.

Looking at the even bigger picture, it's hard to see anything really positive happening.

I've outlined three channel that have been in existence since the 8/09 bottom. The first, in purple, starts with that bottom. It was badly breached in late September - early October. An expanded trend channel, at double the width (not shown) would come close to containing the October 4 low.

The blue channel, up from there, outlines a steep and dramatic retracement. This trend topped on October 27, and the index has been sliding since. I've placed the red channel lines around this decline.

I thought the purple channel was gone after the late September drop, but the lower boundary has been touched several times since mid-October. If the red channel has any validity, this week's penetration of the purple channel bottom signals a new phase of decline.

Looking at the even bigger picture, it's hard to see anything really positive happening.

Thursday, November 3, 2011

Thursday 11-3

Today, nothing definitive happened in Greece. "Stocks rallied for a second day on Thursday as Greece backed away from a

proposed referendum that threatened its membership in the euro, which

could destabilize global markets." So - stocks were strong today because the Greeks decided to not do something that maybe they weren't going to do anyway, and nobody knows what the effects might have been if they had. Well, stock increases climb a wall of fear and uncertainty, so that all makes very good sense.

Another way to look at it is that after a five wave decline covering 3 trading days, the markets are now in a corrective phase. From Thursday's SP500 high of 1292.66, the index bottomed at 1215.42 on Tuesday. Today's high of 1263.21 is only .06 above the .618 retracement level. Of course, there is no particular reason for the advance to stop exactly there. Recent retracement have been quite steep and the .786 level, at 1276.14, is not far off. The way markets move these days, that could be reached in a few seconds of trading.

If the advance were to end now, it would mean that, once again, it faltered at its trend midline. That would be esthetically pleasing, at least. Note also that the open gap from Tuesday's opening has been filled.

If the index doesn't turn down here, I expect it will soon.

Another way to look at it is that after a five wave decline covering 3 trading days, the markets are now in a corrective phase. From Thursday's SP500 high of 1292.66, the index bottomed at 1215.42 on Tuesday. Today's high of 1263.21 is only .06 above the .618 retracement level. Of course, there is no particular reason for the advance to stop exactly there. Recent retracement have been quite steep and the .786 level, at 1276.14, is not far off. The way markets move these days, that could be reached in a few seconds of trading.

If the advance were to end now, it would mean that, once again, it faltered at its trend midline. That would be esthetically pleasing, at least. Note also that the open gap from Tuesday's opening has been filled.

If the index doesn't turn down here, I expect it will soon.

Wednesday, November 2, 2011

Wednesday 11-2

On a day when the Fed did nothing, but projected a bleak outlook going forward and no new revelations came out of Europe to relieve the Greecy mess, the stock market went . . . . . . UP?

Yep: 1.61% for the SP500, 1.53% for the DJI, and a measly 0.87% for the NASDAQ. How to explain? Will, since the top last Thursday, the SP500 has complete 5 waves down, and now there is a correction at some small level of trend.

Here is a longer range view of action over the last year and a half. Again, we see trends within trends and trends faltering at their respective midlines.

The wide channel, outlined in brown, goes back to the 3/6/09 low of 666.79. Within it is the green channel originating with the 8/31/10 low. Note that the trend fails exactly where the two trendlines converge. Yesterday's purple channel is back as well. Extrapolating its midline back shows that it was a support resistance line during the last throes of the brown and green channels.

The red lines represent horizontal support and resistance levels.

Yep: 1.61% for the SP500, 1.53% for the DJI, and a measly 0.87% for the NASDAQ. How to explain? Will, since the top last Thursday, the SP500 has complete 5 waves down, and now there is a correction at some small level of trend.

Here is a longer range view of action over the last year and a half. Again, we see trends within trends and trends faltering at their respective midlines.

The wide channel, outlined in brown, goes back to the 3/6/09 low of 666.79. Within it is the green channel originating with the 8/31/10 low. Note that the trend fails exactly where the two trendlines converge. Yesterday's purple channel is back as well. Extrapolating its midline back shows that it was a support resistance line during the last throes of the brown and green channels.

The red lines represent horizontal support and resistance levels.

Tuesday, November 1, 2011

Tuesday Nov 1

Welcome to a new month. The Major indexes all took a deep dive at the opening today, made a couple of attempts to recover, faltered, and all wound up close to the early morning lows. Losses were 2.5 to 3%. Coupled with yesterday's similarly shaped performance, this could be the beginning of another crash.

Blame it on Greece? Hell, you might as well blame it on the bossa nova. The Greek situation cannot be a surprise to anyone who has been paying the slightest bit of attention and also has a couple of toes planed in reality.

Or not.

On the other hand, maybe they don't read Krugman. Whatever.

Here is a chart of daily ranges in the SP500 Index since the beginning of July. After a deep plunge, it's been basically sideways for three months. What can we make of it? (Click to enlarge.)

Trend Channels

Stocks staged a terrifying drop in early August, which was the first line of a broad "W" formation which seems now to be complete. (I'm not suggesting the "W" shape has any inherent significance - it's just an observation.) This does give us the opportunity to look at the channels that the stock movements have defined.

The initial drop traced out a narrow channel, constructed by placing a line across the tops, then dropping a parallel line across the bottoms. I constructed the blue upward-trending channel the same way, (which is not technically correct, since that should be done be connecting the bottoms. Oh, well, you have to be a bit ad hoc at times; and since the lines are strictly parallel, it hardly matters.) Another red down channel followed, and then the steeply upward green channel.

Let's pause and think about all this Greek stuff in the context of the chart. Could that have caused one big day as the up-trend was exhausted, and then, conversely, two days of steep declines? Believe that if you want too. I find the proposition very difficult to swallow. But people get paid to make that stuff up, and if your perspective is only a few days, ignorance of a bigger picture can make you susceptible to spurious assertions.

Back to the chart: for three of the "W" channels, I've also included a midline in yellow. In the blue channel, the midline seems to offer a bit of temporary support/resistance from time it time. Ditto, for the green channel. Interestingly, in both of those cases, the trend faltered right at its own midline.

To put a bigger perspective on things, I've added the outer purple trend channel, framing all of the other details. That couldn't be done until the recent top was defined. Note that the bottoms of the "W" very cooperatively touch the bottom channel line. Note also that the midline of the purple channel (even before we knew of its existence) was a support/resistance line. The break of the blue channel where three midlines converge is especially intriguing.

Several weeks back, I thought that the break through the bottom of the blue channel signaled the next down phase. This could well be the case now, but it will take a convincing break of the purple channel to validate that notion - somewhere around 1050, I suppose.

Blame it on Greece? Hell, you might as well blame it on the bossa nova. The Greek situation cannot be a surprise to anyone who has been paying the slightest bit of attention and also has a couple of toes planed in reality.

Or not.

If the European rescue falls through and Greece defaults on its debt, the ripple effect would be global. Europe could fall into recession, hurting a major market for American exports, and banks could severely restrict lending.

It was only last Thursday that European leaders announced a deal that they believed would be a turning point in the two-year debt crisis. Banks agreed to take bigger losses on Greek debt and to boost their levels of cash, while the European Union increased the size of its bailout fund. Global stock markets surged after the plan was unveiled. Now, those gains seem to be fleeting.

"The stock market is expressing disgust with Greek politics and a lack of confidence that Italy and Spain will generate the growth needed to pay down their debt," said Peter Boockvar, equity strategist at Miller Tabak & Co.

On the other hand, maybe they don't read Krugman. Whatever.

Here is a chart of daily ranges in the SP500 Index since the beginning of July. After a deep plunge, it's been basically sideways for three months. What can we make of it? (Click to enlarge.)

Trend Channels

Stocks staged a terrifying drop in early August, which was the first line of a broad "W" formation which seems now to be complete. (I'm not suggesting the "W" shape has any inherent significance - it's just an observation.) This does give us the opportunity to look at the channels that the stock movements have defined.

The initial drop traced out a narrow channel, constructed by placing a line across the tops, then dropping a parallel line across the bottoms. I constructed the blue upward-trending channel the same way, (which is not technically correct, since that should be done be connecting the bottoms. Oh, well, you have to be a bit ad hoc at times; and since the lines are strictly parallel, it hardly matters.) Another red down channel followed, and then the steeply upward green channel.

Let's pause and think about all this Greek stuff in the context of the chart. Could that have caused one big day as the up-trend was exhausted, and then, conversely, two days of steep declines? Believe that if you want too. I find the proposition very difficult to swallow. But people get paid to make that stuff up, and if your perspective is only a few days, ignorance of a bigger picture can make you susceptible to spurious assertions.

Back to the chart: for three of the "W" channels, I've also included a midline in yellow. In the blue channel, the midline seems to offer a bit of temporary support/resistance from time it time. Ditto, for the green channel. Interestingly, in both of those cases, the trend faltered right at its own midline.

To put a bigger perspective on things, I've added the outer purple trend channel, framing all of the other details. That couldn't be done until the recent top was defined. Note that the bottoms of the "W" very cooperatively touch the bottom channel line. Note also that the midline of the purple channel (even before we knew of its existence) was a support/resistance line. The break of the blue channel where three midlines converge is especially intriguing.

Several weeks back, I thought that the break through the bottom of the blue channel signaled the next down phase. This could well be the case now, but it will take a convincing break of the purple channel to validate that notion - somewhere around 1050, I suppose.

Monday, October 31, 2011

Monday 10-31

One of the reasons I am totally convinced believe that markets are inefficient is that in two full trading days, the gains from last Thursday have not been totally undone.

Today's loss in the SP500 wasn't even a full 2.5%! (2.47, if you're an accuracy freaque.) The day's action was down at the beginning, down at the end, and bumpy, grinding sideways between.

Just one more day on the roller coaster. The market giveth, the market taketh away.

The market is shocked - shocked, I tell you - that things which were blatantly obvious last week are still blatantly obvious today. Excuse me if I bust out laughing.

Today's loss in the SP500 wasn't even a full 2.5%! (2.47, if you're an accuracy freaque.) The day's action was down at the beginning, down at the end, and bumpy, grinding sideways between.

Just one more day on the roller coaster. The market giveth, the market taketh away.

Investors were worried about the collapse of the brokerage MF Global and missing details in Europe's plan to contain the Greek debt crisis . . .

Bank stocks fell sharply after the brokerage MF Global filed for bankruptcy protection. Last week, the company's debt was downgraded to junk status by ratings agencies concerned about its large holdings of European government debt. The company is headed by former New Jersey Gov. and Goldman Sachs chairman Jon Corzine. Morgan Stanley slumped 8.7 percent, Citigroup Inc. fell 7.5 percent . . .

The Organization for Economic Cooperation and Development warned Monday that European economies will see a "marked slowdown" next year. The organization called on the European Union to provide more information on how it plans to stem the debt crisis . . .

The market is shocked - shocked, I tell you - that things which were blatantly obvious last week are still blatantly obvious today. Excuse me if I bust out laughing.

Sunday, October 30, 2011

Thu-Fri 10/27-28

Stock indexes went berserk on Thursday, with 3+% gains the norm. Over 2% of this came within an instant of the opening. There was a slight slide at the end of the day, and positive follow-through on Friday was nonexistent.

The explanation:

OK. I've got it. A three percent across-the-board single-day gain was justified because of a poorly understood and not-thought-through event ON A DIFFERENT CONTINENT. The next day's lassitude is taking a deep breath, because we need to reassess.

In other words, investors are damned fools, blowing around like leaves in the wind, and really have no idea what the hell they are doing.

Makes sense to me.

I wonder if Webman even realizes he has implicitly refuted the efficient market hypothesis?

The explanation:

Stock indexes jumped more than 3 percent Thursday after European leaders unveiled a plan to expand their regional bailout fund and take other steps to contain the debt crisis in Greece.

Optimism ebbed on Friday as analysts raised questions about the plan, which left out many key details about how the fund would work. European markets mostly fell, and the euro declined against the dollar.

"It's a kind of sobering-up after a day of partying," said Jerry Webman, chief economist with Oppenheimer Funds in New York. "We got back to what's more of a square position, closer to where we want to be, and now we're going to take a couple of deep breaths and reassess what this really means."

There are still plenty of obstacles to overcome before the crisis is resolved. One troubling sign: Borrowing costs for Italy and Spain increased, signaling that traders remain worried about their finances.

OK. I've got it. A three percent across-the-board single-day gain was justified because of a poorly understood and not-thought-through event ON A DIFFERENT CONTINENT. The next day's lassitude is taking a deep breath, because we need to reassess.

In other words, investors are damned fools, blowing around like leaves in the wind, and really have no idea what the hell they are doing.

Makes sense to me.

I wonder if Webman even realizes he has implicitly refuted the efficient market hypothesis?

Thursday, October 27, 2011

Wednesday 10-26

The SP500 index jumped about 15 points at the opening, then proceeded to sag back below Tuesday's close. It then bounced and rolled before climbing to end the day at 1242, close to the early morning peak. Just one more dip in the roller coaster ride.

Tuesday, October 25, 2011

Tuesday 10-25

Today's decline wiped out yesterday's advance. After a quick 20 point drop at the opening, the SP500 recovered about 10 points in an hour, went went mostly sideways until about early afternoon, when it slid again and dropped sharply at the end of the day to 1229.05, for a total loss of 25.14, just about 2%. The DJI and NASDAQ also lost on the day, dropping 1.74% and 2.26%, respectively.

I can't make anything out of the wave form. This could be the decline reasserting itself. Then again - maybe not.

I can't make anything out of the wave form. This could be the decline reasserting itself. Then again - maybe not.

Monday, October 24, 2011

Monday 10-23

As of 1:15 p.m. the SP500 has reached a daily high of 1254.69. This is getting quite close to the 66.67% retracement level of the decline from May 2 to the October 4 low at 1258. This still looks like a counter-current move with more declines to follow.

Update: After rising from 1238.72 at the opening, the SP500 leveld off and spent the afternoon oscillating around the 1253 mark. It topped for the day at 1256.55 shortly before 2:00 p.m., made another stab above 1256 shortly after 3:00, and bounced in at 1254.19 for the close. Momentum is down from a Friday morning peak, slid lower all day, and now is about zero.

On the other hand, the animal spirits were active today: contrary to what I said on Friday, the NASDQ was up about 2.4%, the SP about 1.3%, and the DJI only about 0.75% - inverse to relative blue-chippiness.

Back on the first hand, 1256 is close enough to 1258 to quality as a 2/3 retracement, as far as I'm concerned. Not to say that the recovery is necessarily over quite yet, though - we'll have to see what happens the rest of the week.

Update: After rising from 1238.72 at the opening, the SP500 leveld off and spent the afternoon oscillating around the 1253 mark. It topped for the day at 1256.55 shortly before 2:00 p.m., made another stab above 1256 shortly after 3:00, and bounced in at 1254.19 for the close. Momentum is down from a Friday morning peak, slid lower all day, and now is about zero.

On the other hand, the animal spirits were active today: contrary to what I said on Friday, the NASDQ was up about 2.4%, the SP about 1.3%, and the DJI only about 0.75% - inverse to relative blue-chippiness.

Back on the first hand, 1256 is close enough to 1258 to quality as a 2/3 retracement, as far as I'm concerned. Not to say that the recovery is necessarily over quite yet, though - we'll have to see what happens the rest of the week.

Friday, October 21, 2011

Friday 10-21

The NASDAQ is now slipping behind the DJI and SP500. At a detail level, the late day surge took the DJI above the morning high. The SP500 finish fell less than a point short of the morning high of 1239.03. The NASDAQ never challenged the morning high. If this is the start of a trend, it would reflect a kind of flight to quality, as the blue chips out-perform their lesser brethren. In a downturn, outperforming means not doing as bad as.

The current advance probably has some legs left in it - though the NASDAQ might already have run out of steam. The .667 retracement level in the SP500 is around 1258 - less than 20 points from today's high. It might take a few days to get there.

Then, the decline can resume in earnest.

Thursday, October 20, 2011

Thursday 10-20

Today, the SP500 started off continuing yesterday's slide. This reversed shortly after noon, and the ensuing move up retraced just about 2/3 of the drop from the high late Tuesday afternoon. Cycles within cycles.

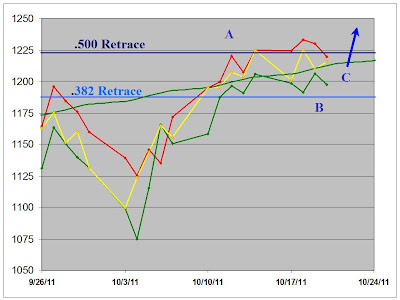

Taking a somewhat longer view, here is an updated close up of the first graph from last Thursday.

The daily highs. lows, and closings are in red, green, and yellow, respectively. For the last 9 or 10 days, the movement has been sideways, and mostly contained between the .382 and .500 retracement levels of the drop from the May 2 high to the October 4 low. Evidently this stage of the correction is tracing out some sort of flat. This implies that a new recovery high will be achieved before the next down wave begins. For what it's worth, these moves have also been hugging the continuation of the former lower boundary of the up-slanting August-September trading channel.

Something will have to break soon

Taking a somewhat longer view, here is an updated close up of the first graph from last Thursday.

The daily highs. lows, and closings are in red, green, and yellow, respectively. For the last 9 or 10 days, the movement has been sideways, and mostly contained between the .382 and .500 retracement levels of the drop from the May 2 high to the October 4 low. Evidently this stage of the correction is tracing out some sort of flat. This implies that a new recovery high will be achieved before the next down wave begins. For what it's worth, these moves have also been hugging the continuation of the former lower boundary of the up-slanting August-September trading channel.

Something will have to break soon

Wednesday, October 19, 2011

Wednesday 10-19

The SP500 chopped around near 1225, the area of yesterday's close, from the opening through about 2:00 p.m. Then it lost 20 points in an hour or so, and then chopped around near the 1210 level for the rest of the day, closing at 1209.88.

The theme for the last 6 or so weeks, despite some dramatic daily moves, has been sideways. This has been a corrective pause in the downward thrust that began with the May 2 high. The difficulty is extracting from all this hash the start of the next down phase. Eventually, this will become clear - sometime in the next several days or weeks. In all likelihood, a significant downward move is ahead of us. We just don't know when.

.

The theme for the last 6 or so weeks, despite some dramatic daily moves, has been sideways. This has been a corrective pause in the downward thrust that began with the May 2 high. The difficulty is extracting from all this hash the start of the next down phase. Eventually, this will become clear - sometime in the next several days or weeks. In all likelihood, a significant downward move is ahead of us. We just don't know when.

.

Tuesday, October 18, 2011

Tuesday, 10-18

Yesterday's decline in the SP 500 index continued past today's opening, looking like it might be the start of something. Then it turned around and the strong move late in the day gave us the highest intra-day high (1233.10) since August 4, when the index was falling fast and hard from around 1350.

The corrective wave continues.

.

The corrective wave continues.

.

Monday, October 17, 2011

Monday 10-17

After a quick drop at the opening, today's decline was neat and orderly. This is probably the beginning of the next down phase I mentioned on Thursday. The wave action appears to be at quite a small level of trend.

It was a consistent down day, with all the major indexes dropping - even oil and precious metals - and a decline in all 30 DJI stocks. In fact, the blue chips got hit harder than the more speculative issues.

DJI -2.13%

SPX -1.94%

NDX -1.58%

Note that I've added an interactive chart widget at the top of the page, courtesy of freestockcharts.com. Play around with it a little bit. It's quite versatile.

It was a consistent down day, with all the major indexes dropping - even oil and precious metals - and a decline in all 30 DJI stocks. In fact, the blue chips got hit harder than the more speculative issues.

DJI -2.13%

SPX -1.94%

NDX -1.58%

Note that I've added an interactive chart widget at the top of the page, courtesy of freestockcharts.com. Play around with it a little bit. It's quite versatile.

Friday, October 14, 2011

Fri 10-14

This morning's near-vertical rise filled the open gap from Wednesday, and also reached a new intermediate high, edging out Wednesday's 1220.25 by an additional 1.19. This appears to be a continuation of the correction from either the 10/04 or 8/09 low. Since 8/09, only the declines have had an impulsive look. The advances have been overlapping, and look like corrective waves.

Not much to add, unless something dramatic happens in the next hour and a half.

Update: I won't say this is dramatic, but the index did inch a bit higher today, topping at 1224.61 before slipping back a hair to close at 1224.58. Hmmm. Now the chart at Yahoo shows an opening gap up. Earlier in the day, it showed an actual steep climb. I have my doubts about the accuracy of the Yahoo charts - at least at a detail level. But I don't know where to get anything better. And, they're free.

Not much to add, unless something dramatic happens in the next hour and a half.

Update: I won't say this is dramatic, but the index did inch a bit higher today, topping at 1224.61 before slipping back a hair to close at 1224.58. Hmmm. Now the chart at Yahoo shows an opening gap up. Earlier in the day, it showed an actual steep climb. I have my doubts about the accuracy of the Yahoo charts - at least at a detail level. But I don't know where to get anything better. And, they're free.

Thursday, October 13, 2011

Thursday Market Action

It looks like the most recent corrective wave might have finished, and the decline can resume.

Sometimes, it pays to take a step back and have another look at the big picture. I was surprised by the scope of this advance because I thought it was occurring at a lower level of trend. It now seems clear that the correction is occurring at a higher level.

The next open question is the wave count. I've been operating on the presumption that the October 4 low was the end of a downward impulse, and the correction that followed was a zig zag pattern. This may still be correct, but there is another possibility worth considering, and that is that the bottom of the impulse was way back on August 9. If this is the case, then all that has transpired since has been part of a running flat corrective pattern.

The alternate wave counts are from the October 12 Elliott Wave Short Term Update. The charts are mine.

The two charts below illustrate these possibilities. Daily highs are traced by the red lines, lows by green, and closings by yellow. The channel for the zig zag correction is included, as are the .382; .500; and .618 retracement levels, based on a May 5 top. For these charts, I'm assuming today's highs and lows are already in, and left the closing value open.

By either wave form, the next expected move is down.

Sometimes, it pays to take a step back and have another look at the big picture. I was surprised by the scope of this advance because I thought it was occurring at a lower level of trend. It now seems clear that the correction is occurring at a higher level.

The next open question is the wave count. I've been operating on the presumption that the October 4 low was the end of a downward impulse, and the correction that followed was a zig zag pattern. This may still be correct, but there is another possibility worth considering, and that is that the bottom of the impulse was way back on August 9. If this is the case, then all that has transpired since has been part of a running flat corrective pattern.

The alternate wave counts are from the October 12 Elliott Wave Short Term Update. The charts are mine.

The two charts below illustrate these possibilities. Daily highs are traced by the red lines, lows by green, and closings by yellow. The channel for the zig zag correction is included, as are the .382; .500; and .618 retracement levels, based on a May 5 top. For these charts, I'm assuming today's highs and lows are already in, and left the closing value open.

By either wave form, the next expected move is down.

Subscribe to:

Comments (Atom)